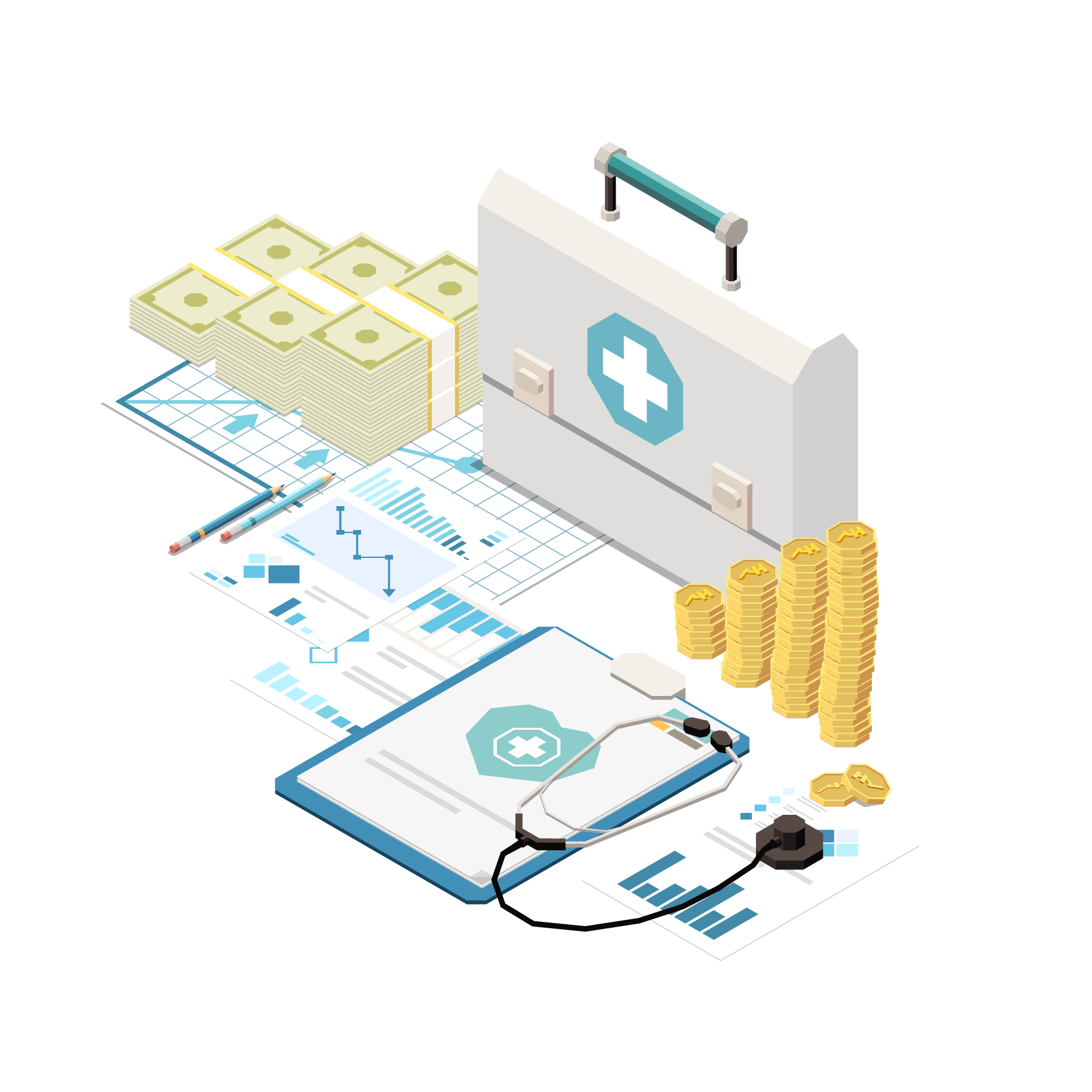

Zero Cost

Medical Loans

Get immediate access to the best healthcare services without financial stress.

Fast

Approvals

Quick and efficient application process with fast approvals.

Wide Network

of Hospitals

Choose from a verified list of 10,000+ hospitals across India for reliable medical care.

Secure and

Reliable

Robust security measures to protect your data & ensure a trustworthy healthcare financing experience.

Some of Our Hospital Partners

Customer Experience

Real Reviews from our satisfied customers.

I am incredibly happy with my health plan. The benefits are exceptional and something I actually use.

.jpg)

I now have 360 protections with AyushPay Platinum plan after getting even my

Diagnostic test

covered.

.jpg)

Protecting my health today as well as tomorrow has been the best decision. And no better partner than AyushPay Platinum plan.

.jpg)